Yesterday, I wrote that Gospel for Asia may be in conflict with IRS guidelines regarding granting U.S. tax exempt donations to foreign entities. Today, I want to compare publicly available information about GFA to the Evangelical Council for Financial Accountability’s Guideline Four. In this post, I am specifically interested in the ECFA requirements for members who send money to foreign organizations and affiliates.

Yesterday, I wrote that Gospel for Asia may be in conflict with IRS guidelines regarding granting U.S. tax exempt donations to foreign entities. Today, I want to compare publicly available information about GFA to the Evangelical Council for Financial Accountability’s Guideline Four. In this post, I am specifically interested in the ECFA requirements for members who send money to foreign organizations and affiliates.

ECFA members are required to adhere to the following guidelines:

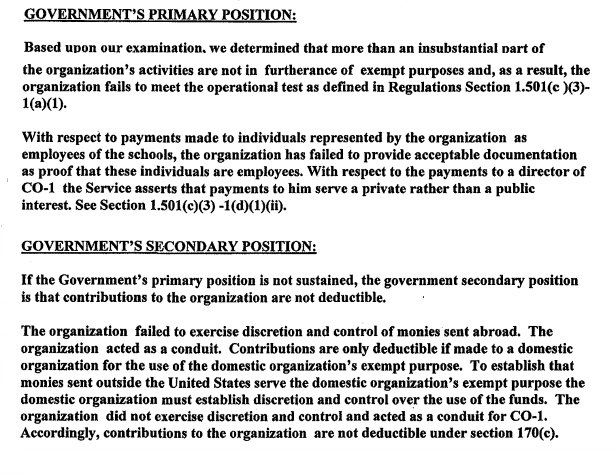

International grant-making. U.S. tax law does not prohibit the making of grants by a U.S. tax-exempt organization to recipients in other countries if they further the U.S. organization’s tax-exempt purposes. However, the IRS has articulated some parameters as to when contributions may or may not be deductible for tax purposes, if they are made to a U.S. charity and subsequently distributed in the form of a grant to a foreign recipient.

The reason for IRS scrutiny of such grants is because only donations to a U.S. tax-exempt organization are deductible as charitable contributions. Contributions by a U.S. taxpayer to a foreign organization are not tax-deductible.

A U.S. charity may not act merely as a conduit of funds for a foreign recipient. This would result in treating these indirect contributions to a foreign organization as tax-deductible contributions, something that would not be allowed if the funds were made directly to the foreign entity.

However, if a grant is made by a U.S. charity to further its exempt purposes, and if the grant funds are clearly under the control and discretion of the U.S. charity rather than the donor, it is unlikely that the IRS will challenge the deductibility of the gift.

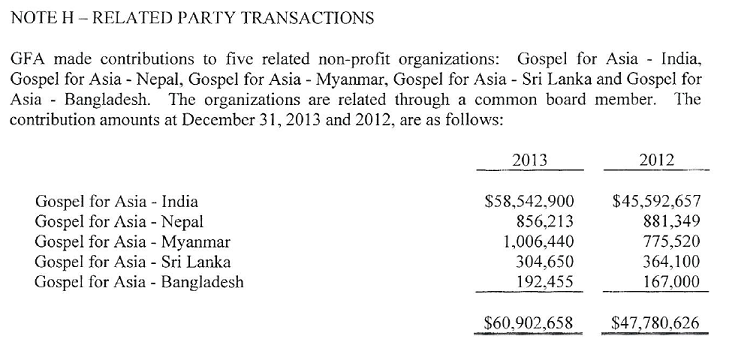

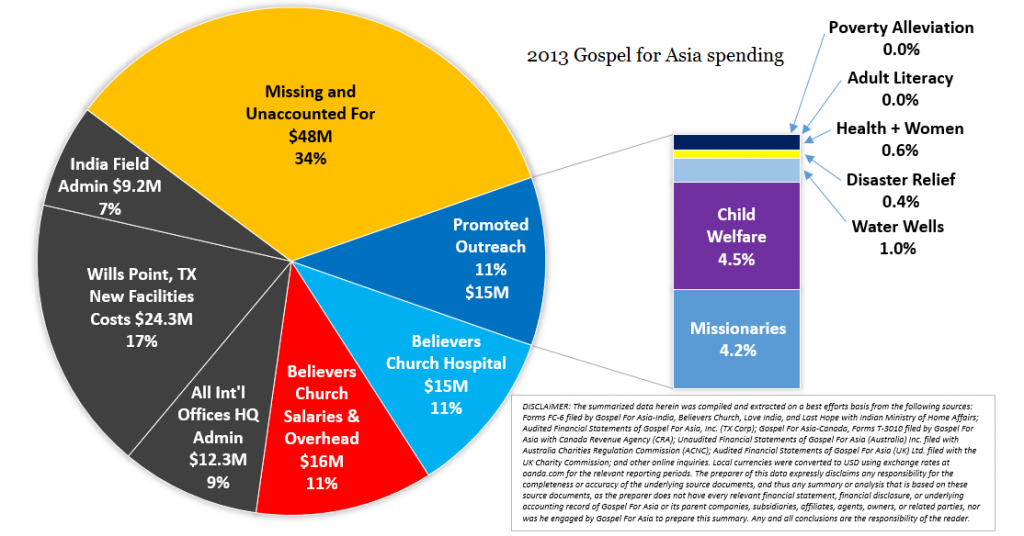

The issue of “discretion and control” is what I raised yesterday. GFA-US did not disclose millions of dollars of U.S. donor money given to Believers’ Church, Love India Ministry and Last Hour Ministry in the 2013 annual audit. Instead, GFA-US claimed that $58.5 million went to GFA-India. However, GFA-India only disclosed $6.5 million in donations from the United States. Even if donations from GFA-US to the other three NGOs were listed in the 2013 audit, $30.5 million dollars still went unreported in India in 2013 (see this article for the breakdown).

The real donees for about $28 million dollars from U.S. donors are Believers’ Church, Love India Ministry and Last Hour Ministry. According to GFA-US, Believers’ Church is a separate organization legally. Recently, David Carroll told Christian Today:

GFA’s Chief Operating Officer David Carroll told Christian Today that it was important to understand that GFA India and Believers Church were separate entities from Gospel for Asia USA.

Carroll said that the Indian GFA and Believers’ Church are responsible for dispersing the funds:

“Though Gospel for Asia India and Believers Church is responsible for dispersing the funds, they know the requests of the donors for the specific designations the money was given for and they are fastidious about documenting the disbursement of donor funds. The donations go where they have been designated.”

It may be true that the donations go where the donors want, but then again they may not. GFA has given the public reasons to question. David Carroll wants us to take his word that GFA-India and Believers’ Church spend the money in keeping with donor intent. However, when auditor Jason Watkins, pastor and former donor Bruce Morrison, and I analysed the public reports of GFA-India’s and Believers’ Church’s spending in India, we couldn’t find millions of dollars GFA-US said was sent to India. The reports of what was received in India don’t match the claims of giving in the U.S. In response to questions about the discrepancy, GFA has been silent. Furthermore, an Indian tax court recently wrote that GFA used funds for reasons not in keeping with the intended purpose. Without a plausible accounting of millions of donor dollars, why should the donor public believe that GFA-India and BC are spending the funds they do report in keeping with donor intent?

The guidelines continue:

Organizations may seek professional counsel concerning operations that result in grants to foreign recipients. Various rulings and tax cases stipulate certain characteristics in evaluating whether grants to foreign recipients are proper, exempt-purpose expenditures of the U.S. charity and, therefore, if any supporting gifts actually are deductible by donors of those funds.

Impact of international operations on the financial statements. It is important for organizations to properly control, adequately account for, responsibly audit, and fully disclose in their financial statements the nature and scope of their operations, both within the U.S. and internationally. Organizations and their auditors should consider the impact of worldwide operations on the scope of the audit, and the financial statements should report on all organizational assets, liabilities, revenue, and expenses.

This guideline is not being met. The 2012 and 2013 audits do not disclose funds given to Believers’ Church, Love India Ministry and Last Hour Ministry. The amount claimed to be given to GFA-India by GFA-US comes nowhere close to matching up with what is reported in India. Furthermore, GFA’s audit doesn’t include $14 million USD given by Canadians, supposedly to India, but not reported in India. According to GFA’s COO David Carroll, Canadian funds are lumped in with the U.S. funds and reported together. However, that makes the discrepancy $14 million greater since GFA-India does not report a penny coming from Canada.

The publicly available audit provided by GFA does not fully disclose their operations within the U.S. and internationally. This has been true for years and yet GFA has used the ECFA seal of approval to claim financial health and integrity. As recently as June 10, the ECFA told Christian Today:

Regarding apparent financial discrepancies, it said: “There are certain foreign NGOs that include ‘Gospel for Asia’ in their name. The data of those NGOs is not consolidated with that of Gospel for Asia (US) for financial statements purposes.”

Why not? ECFA’s guideline four certainly appears to require consolidated reports.

It [ECFA] concluded: “Gospel for Asia is in full compliance with ECFA in requiring our members to provide a copy of its current financial statements upon written request and other disclosures as the law may require. The organisation has gone beyond what the law requires by submitting to ECFA’s accreditation process.”

Is GFA-US (and ECFA) really going to claim that these GFA NGOs are not part of their international operations? If so, then how can GFA-US claim that they exercise “discretion and control” over the donations given by U.S. tax payers? If GFA-India and Believers’ Church are so autonomous that they are not part of ECFA-required financial reporting, then how can U.S. donors be confident that GFA-US has sufficient “discretion and control” to make sure those dollars are going where donors specify? This question is especially relevant since the reports filed by the Indian recipients of U.S. donations to GFA don’t match what GFA claims they send to India.

Back to the guidelines:

To be “unqualified” or “clean,” an independent auditor’s report must reflect no restriction on the scope of the audit.

The reach of an organization extends to activities conducted under its control (internationally) when expenditures are made to further its exempt purposes to compensate workers, pay business expenses, provide benevolence to the poor and needy, or to make exempt-purpose grants.

These “exempt purposes” are among the purposes reported in India for funds sent by GFA in Texas.

The guidelines continue:

In order for financial statements to be in conformity with generally accepted accounting principles (GAAP), they must accurately portray the full range of the organization’s operations internationally.

A review of GFA’s 2012 and 2013 audits makes it clear that GFA is in violation of this statement. The financial status of the Indian affiliate (what GFA-India is called in the 2013 financial statement) is not reported, nor are donations to Believers’ Church, Love India Ministry and Last Hour Ministry reported in the audit. I should add that the funds smurfed to India via student groups illegally carrying money to India without being declared in the United States is not referred to in the 2012 and 2013 audits.

Guideline 4 continues:

The FASB Accounting Standards Codification 958-205 (Topic 205, “Presentation of Financial Statements”) sets forth that such statements must focus on the organization as a whole, including its total assets, liabilities, net assets, revenue, expenses, and changes in net assets. In addition, ASC-810 (Topic 810, “Consolidation”) helps guide a reporting organization as to when it must consolidate another not-for-profit organization in which it has a controlling financial interest.

Significant granting activities should be properly disclosed in an organization’s financial statements, including a description of the nature and purpose of the grants and the grant administration policies.

I think $20.6 million to Believers’ Church, $3.6 million to Last Hour Ministry and $3.6 million to Love India Ministry would have to be considered “significant granting activity.” These are not disclosed in the financial audit done by Bland Garvey; and yet ECFA declares GFA to be in compliance.

Guideline 4 continues:

Grant administration policies should be well-developed and approved by the governing board, while adaptable to a wide range of circumstances. The following are possible controls and accountability measures:

- Written progress reports

- Required accounting or financial statements

- Required internal or independent audits and inspections

- On-site program inspections by grantor personnel

- Retaining discretion as to when funds will be remitted based on administration policies and grant agreements, including the policy and practice of refusing conditional or earmarked gifts that create an obligation to remit the funds immediately

- Adequate oversight (supervision) and review (program evaluation) or compliance with administration policies by the governing board and/or the organization’s independent auditors

Conformity with applicable laws and regulations. Standard 4 establishes the guideline that ECFA accredited organizations shall use resources in conformity with applicable laws and regulations. The standard provides a caveat that biblical mandates may be taken into account when considering conformity with laws and regulations. In select situations, an accredited organization may feel compelled to take actions that are in conflict with certain laws, i.e., with respect to religious freedoms and carrying out the Great Commission.

The ECFA requires the board and auditors to maintain oversight sufficient to insure that the organizations policies are being carried out. The public doesn’t know why millions of dollars don’t show up in Indian reports. However, it is known and now admitted that GFA violated its own policies regarding cash transfers to India via smuggling cash via students. GFA claims to only send money to foreign destinations via bank wire. For some undisclosed period of time an undisclosed sum of cash was sent to India without declaring the cash to U.S. or India customs. ECFA and GFA want all of that to go away by saying they won’t do it again.

What donors should understand is that GFA was a member in good standing the entire time they violated their own and ECFA’s standards. They remain a member in good standing with no consequences at all to that standing.

For ECFA purposes only, the last section may give GFA some wiggle room to keep secrets about reporting funds received in India. If GFA-India isn’t reporting all of the income that GFA-US claims is going there (we already know an Indian court has asserted that all the funds are not being used for the intended purposes), this would be a violation of Indian law. The lack of reporting of Canada as a source of $14 million USD appears to be a violation of Indian law. GFA might claim that the lack of reporting was due to protecting missionaries in some way. This seems to be the GFA response line but I have heard no plausible explanation about how non-disclosure of some funds but not others protects anyone’s safety.