For months, Trump said he would release his tax returns. Then he said he was getting them ready. Then he said he would release them once his audit was complete. See RedState for the details.

Now Trump says he won’t release them. Nothing is preventing him but himself.

As Jennifer Rubin points out, GOP delegates can apply some pressure. Trump may have opened himself up to a contested convention, delegates or not. Delegates should abstain unless Trump provides the information.

This is another promise broken and he hasn’t even gotten to the convention.

Tag: IRS

With David Barton as Principal Officer, Non-Profit Mercury One Gave $100k to Barton's Wallbuilders

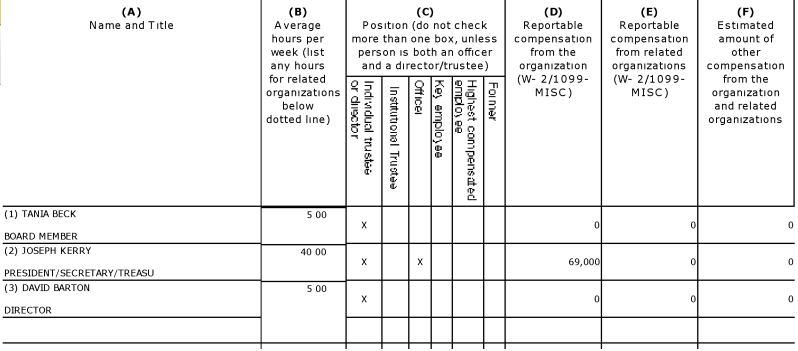

Sometime in 2013, Mercury One, a non-profit founded by Glenn Beck but run by principal officer David Barton, gave $100,000 to Barton’s Wallbuilders, also a non-profit run by Barton. Such gifts appear to be questionable under IRS guidelines addressing gifts which benefit insiders.

Barton founded and is head of Wallbuilders, and was recently tapped to run the Keep the Promise group of Super PACs with over $38 million to spend supporting Ted Cruz.

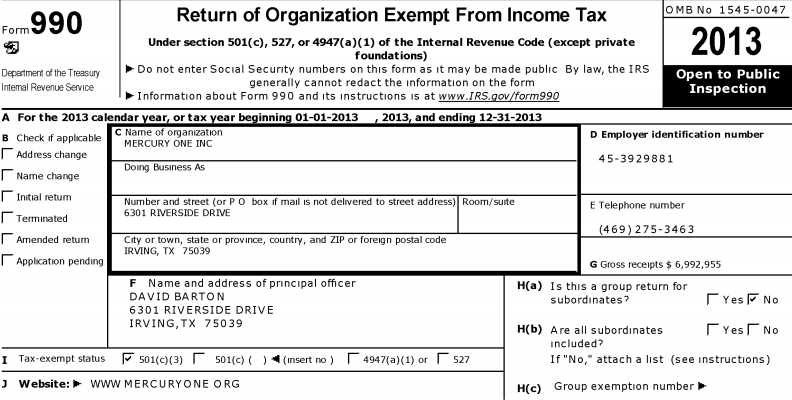

On Mercury One’s 2013 990 form, Barton is listed in box F as the principal officer:

The IRS describes the principal officer (page 9):

For purposes of this item, “principal officer” means an officer of the organization who, regardless of title, has ultimate responsibility for implementing the decisions of the organization’s governing body, or for supervising the management, administration, or operation of the organization.

Thus, if Mercury One filed the 990 properly, Barton has ultimate responsibility for operating the non-profit. Without examining anything else, that is a noteworthy finding.

Barton is also listed as officer along with only two other board members, Glenn Beck’s wife and his longtime attorney and researcher, Joseph Kerry.

Certainly by the standards of the Evangelical Council for Financial Accountability, this is an unacceptable composition for a board. None of these people are independent and it seems improper for Kerry to assume three positions. As principal officer, Barton only needs one other person to vote with him to do anything.

Later, the 990 reports that Wallbuilders received $100, 000. This gift accounts for about 7.5% of the income Wallbuilders received in gifts and grants in 2013.

According to the IRS, non-profits are for the public interest and not private interest.

Private Benefit and Inurement

A public charity is prohibited from allowing more than an insubstantial accrual of private benefit to individuals or organizations. This restriction is to ensure that a tax-exempt organization serves a public interest, not a private one. If a private benefit is more than incidental, it could jeopardize the organization’s tax-exempt status.

No part of an organization’s net earnings may inure to the benefit of an insider. An insider is a person who has a personal or private interest in the activities of the organization such as an officer, director, or a key employee. This means that an organization is prohibited from allowing its income or assets to accrue to insiders. An example of prohibited inurement would include payment of unreasonable compensation to an insider. Any amount of inurement may be grounds for loss of tax-exempt status.

If a public charity provides an economic benefit to any person who is in a position to exercise substantial influence over its affairs (that exceeds the value of any goods or services provided in consideration), the organization has engaged in an excess benefit transaction. A public charity that engages in such a transaction must report it to the IRS. Excise taxes are imposed on any person who engages in an excess benefit transaction with a public charity, and on any organization manager who knowingly approves such a transaction. (See Reporting Excess Benefit Transactions on page 12).

Only the IRS can make a final determination but this transaction looks like it is worth exploring. Barton certainly is an insider at Mercury One and, via Wallbuilders, he benefited from the gift. The $100,000 is almost as much as Barton reported as compensation in 2013.

Gospel for Asia and ECFA: Is Reporting Information About An Organization Harassment?

Gospel for Asia has not answered any requests for information from me since May 7. GFA’s COO David Carroll told me my questions had become too frequent and numerous for them. Former donors have also asked many of the same questions I have asked. Many former donors have written to tell me that GFA representatives said the Evangelical Council for Financial Accountability advised GFA not to talk to me. I have seen evidence that GFA is internally telling staff that they refuse to answer questions from me at the advice of ECFA. That would not be surprising since ECFA has not responded to my questions for months.

If indeed ECFA is advising a member organization not to answer questions from me, what could be the reason? I will address a possible rationale in a moment. However, before I do, it is worth asking GFA publicly: why won’t you answer questions from donors? Former donor and Canadian pastor Bruce Morrison asked you many questions about discrepancies between U.S. records and Indian reports. You didn’t answer them. He and his church supported GFA for 20 years. Former donor and blogger Jimmy Humphrey supported GFA for years until recently. However, he told me you didn’t have any answers when he wanted to know why discrepancies exist between U.S. and Indian records. GFA sent him a form letter but no specific answers. I have heard similar stories from over a dozen former donors; some of them are posting at the Phoenix Preacher blog (see the comments section of this post).

Now about GFA’s silence in response to my questions:

The ECFA has a guideline called Transparency. Generally, it encourages organizations to be open about their dealings and specifies that ECFA member organizations must provide an audited financial statement upon request. GFA provided me with a copy of that statement when I asked back in April. This is the one area where compliance with ECFA guidelines has been advantageous. If the ECFA sticks by its own rules, the 2014 audited statement should be available soon because it was due to be filed with ECFA by July 31.

An aspect of the Transparency guideline gives a member organization a loophole for disclosure of the audited statement. If the organization deems that the request is part of a harassment campaign, then the group is exempt.

Harassment campaign. An organization may be exempted from the requirement to provide a copy of its financial statement if ECFA determines that the organization is the subject of a harassment campaign, the requester is part of that campaign, and compliance with requests that are part of that campaign are not in the public interest.

What constitutes harassment? A group of requests for an organization’s documents is indicative of a harassment campaign if the requests are part of a single, coordinated effort meant to disrupt the operations of the organization rather than to collect information about the organization.

In ECFA speak, this exemption applies to requests for audited financial statements and is based on IRS guidance about disclosure of a tax exempt organization’s 990 form. Since tax exempt groups are supposed to operate for the public benefit, public accountability is served by the government requiring non-profits to file a disclosure of income and expenses via the 990 form. However, GFA doesn’t file a 990 since the organization is considered a religious order by the IRS.

The ECFA spells this out to members in a document on their website which provides the relevant IRS guidance. Reviewing the IRS guidance, it becomes clear that ECFA has adapted IRS language to their guideline for disclosure of financial statements. Organizations are not required to provide 990 forms under the following circumstances:

§ 301.6104(d)–3 Tax-exempt organization subject to harassment campaign. (a) In general. If the district director for the key district in which the [26 CFR Ch. I (4–1–06 Edition)] organization’s principal office is located (or such other person as the Commissioner may designate) determines that the organization is the subject of a harassment campaign and compliance with the requests that are part of the harassment campaign would not be in the public interest, a tax-exempt organization is not required to fulfill a request for a copy (as otherwise required by § 301.6104(d)–1(a)) that it reasonably believes is part of the campaign.

What defines harassment?

(b) Harassment. A group of requests for an organization’s application for tax exemption or annual information returns is indicative of a harassment campaign if the requests are part of a single coordinated effort to disrupt the operations of a tax-exempt organization, rather than to collect information about the organization. Whether a group of requests constitutes such a harassment campaign depends on the relevant facts and circumstances. Facts and circumstances that indicate the organization is the subject of a harassment campaign include: a sudden increase in the number of requests; an extraordinary number of requests made through form letters or similarly worded correspondence; evidence of a purpose to deter significantly the organization’s employees or volunteers from pursuing the organization’s exempt purpose; requests that contain language hostile to the organization; direct evidence of bad faith by organizers of the purported harassment campaign; evidence that the organization has already provided the requested documents to a member of the purported harassing group; and a demonstration by the tax-exempt organization that it routinely provides copies of its documents upon request.

The IRS does not require non-profits to answer endless requests for the same form from coordinated sources. Doing so would take up too much time and resources and might be designed to disrupt the organization’s functioning. Even so, an organization cannot simply declare itself the subject of a harassment campaign and be free from the disclosure requirement. The organization has to request a determination by the IRS within 10 days of the organization’s leaders believing the organization to be the subject of a harassment campaign. According to the guidelines:

(d) Harassment determination procedure. A tax-exempt organization may apply for a determination that it is the subject of a harassment campaign and that compliance with requests that are part of the campaign would not be in the public interest by submitting a signed application to the district director for the key district where the organization’s principal office is located (or such other person as the Commissioner may designate).

To my knowledge, Gospel for Asia has not requested any such determination. You can read the rest of the procedure at this link (page 91).

Clearly, none of this applies to media, public, or donor requests for information about financial dealings. Neither the IRS nor the ECFA guidelines advise or allow a public charity to ignore questions about public documents (audited statements, reports filed with the Canadian and Indian governments) already filed by the organization. If indeed the ECFA advised a Christian ministry to refuse to answer questions about finances from other Christians, then we have a whole new way of defining “evangelical financial accountability.”

Clearly, none of this applies to media, public, or donor requests for information about financial dealings. Neither the IRS nor the ECFA guidelines advise or allow a public charity to ignore questions about public documents (audited statements, reports filed with the Canadian and Indian governments) already filed by the organization. If indeed the ECFA advised a Christian ministry to refuse to answer questions about finances from other Christians, then we have a whole new way of defining “evangelical financial accountability.”

In the Public Interest

Let’s make this very clear. There is no harassment campaign. GFA did not try to work with me as one GFA representative said according to former donor Jimmy Humphrey. There is no reason in the public interest either here or in India for GFA to hide information or fail to answer questions about discrepancies in financial reports available freely to the public. There is no reason in the public interest for the ECFA to advise their member organizations not to talk to me or any other writer.

If anything is true, it is that GFA has operated in such a way as to thwart the public’s interest in knowing how tax exempt donations are spent. For instance, without brave former staffers disclosing the money smuggling to India, the public wouldn’t know that, GFA, a tax exempt religious order, conducted business in violation of its own standards and possibly U.S. Customs law. GFA began by telling staff that the procedure was legal and they cleared it with their auditors. Later, ECFA told Christian Today that GFA was seeking “legal counsel” to determine “remedial measures”:

It confirmed that GFA had sent cash with individuals travelling to India, but said that it had “stopped this practice entirely, and is working with legal counsel to determine appropriate remedial measures, if any”.

If the practice is legal and cleared with auditors Bland Garvey, why check with lawyers?

Maybe there are good answers for every question. If so, the public interest demands that GFA answer them. If not, then whose interest is served by silence?

How Does Gospel for Asia Exercise Discretion and Control of U.S. Tax-Exempt Contributions Given to Asia?

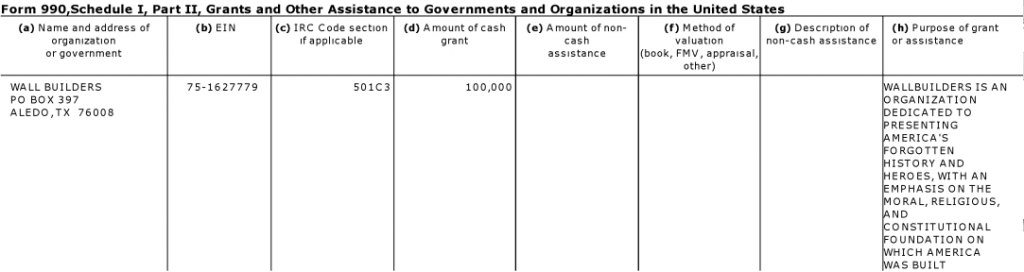

Other than to operate the School of Discipleship, Gospel for Asia in Texas appears to exist to collect donations and send them to various countries in Asia where locals carry out various charitable and religious activities. The foreign donations are wired (or smuggled) to NGOs in India and other nations in Asia. According to GFA’s 2013 audit financial statement nearly $60.1 million dollars were wired to five GFA related parties in India, Myanmar, Nepal, Sri Lanka, and Bangladesh. See below:

In addition, we know that GFA also sent money to Believers’ Church, Last Hour Ministry, and Love India Ministry, three NGOs registered with the Indian government. For some reason, these transactions were not disclosed in the 2013 audit as related party transactions, even though K.P. Yohannan is involved with those organizations. These contributions claimed by GFA to the related parties is a substantial part of what GFA takes in from American donors. As I have pointed out before, a substantial amount of this money does not show up on reports of foreign contributions which are required to be filed with the Indian government (see below).

These facts might be of some consequence if the IRS decides to look into GFA’s operations. In June of this year, the Evangelical Council for Financial Accountability posted the following advice for member organizations. As I read it, this advice and the IRS decision has relevance to GFA.

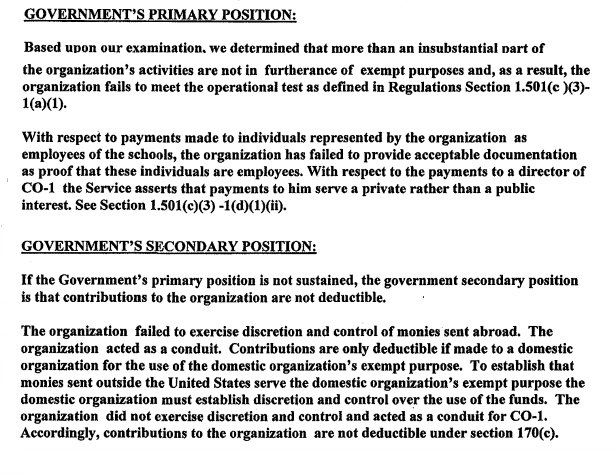

Earlier this year the IRS stripped the tax-exempt status of an unnamed “American Friends of” organization because more than a substantial part of the organization’s activities did not further its exempt purpose. However, the IRS stated that even if its ruling would be overturned on appeal, contributions to the organization would nonetheless not be deductible because the organization failed to exercise sufficient control and discretion over its funds.

“American Friends of” organizations support the exempt purposes of foreign organizations by raising financial support for them in the United States. Donations to an “American Friends of” organization are generally deductible, but only if the organization can prove it exercises sufficient control and discretion over the donated funds to ensure that the funds are being used to further the exempt purposes of the organization. In other words, to maintain deductibility of donations, an “American Friends of” organization must be more than a conduit; rather, it must exercise full control and discretion over where its funds are distributed and how they are used.

In the recent ruling, there were two key factors identified by the IRS in determining that the organization was acting as a conduit between donors in the United States and the foreign organization. First, the organization did not maintain contemporaneous substantiation that it exercised control and discretion of its funds as outlined in Revenue Rulings 63-252 and 66-79. Second, the organization could not prove that it funded specific projects which it reviewed in advance; rather, the evidence showed that disbursements were made for the general operating expenses of the foreign organization.

This ruling is a reminder of the importance of keeping detailed, contemporaneous records to substantiate how an organization exercises control and discretion over its funds, particularly when disbursements are made to organizations to which deductible contributions cannot be made directly (which includes many foreign exempt organizations). For additional details, the IRS ruling can be accessed via this link.

The link leads to a redacted IRS determination regarding tax exempt status of an unnamed organization with most operation in a foreign country. The conclusion was Is GFA-India (and the other countries) a related party or is GFA-United States doing business in India as GFA-India? I may not be asking this precisely but the point of the question is to wonder out loud if GFA leaders in America are in charge of how American contributions are spent in India. The FC-6 reports filed by GFA-India, Believers’ Church, Last Hour Ministry and Love India Ministry indicate that funds are spent for salaries and other operating costs, as was the case with the unnamed charity which was investigated by the IRS. A fair question for GFA is: Who is exercising “discretion and control” of the funds sent to GFA-India, Believers’ Church, Love India Ministry and Last Hour Ministry?

Is GFA-India (and the other countries) a related party or is GFA-United States doing business in India as GFA-India? I may not be asking this precisely but the point of the question is to wonder out loud if GFA leaders in America are in charge of how American contributions are spent in India. The FC-6 reports filed by GFA-India, Believers’ Church, Last Hour Ministry and Love India Ministry indicate that funds are spent for salaries and other operating costs, as was the case with the unnamed charity which was investigated by the IRS. A fair question for GFA is: Who is exercising “discretion and control” of the funds sent to GFA-India, Believers’ Church, Love India Ministry and Last Hour Ministry?

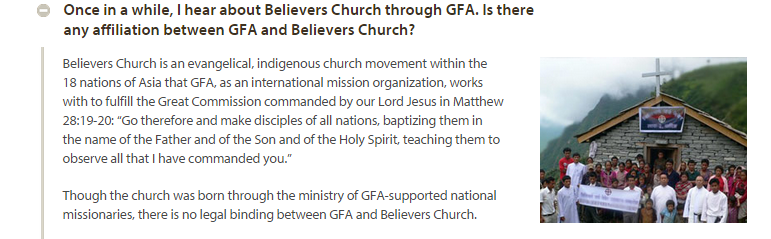

In this context, it is concerning that Believers’ Church, Love India Ministry and Last Hour Ministry are not mentioned in the audit, nor is it clear that GFA-US even claims “discretion and control” of funds sent to these groups. For instance, according to GFA’s website, Believers’ Church and GFA have no “legal binding” relationship:

How then can GFA-US have “discretion and control” of the funds donated to GFA but given by GFA to Believers’ Church? Perhaps that is why BC builds hospitals and schools and runs a micro-finance lending organization and in Myanmar even sponsors a soccer team.

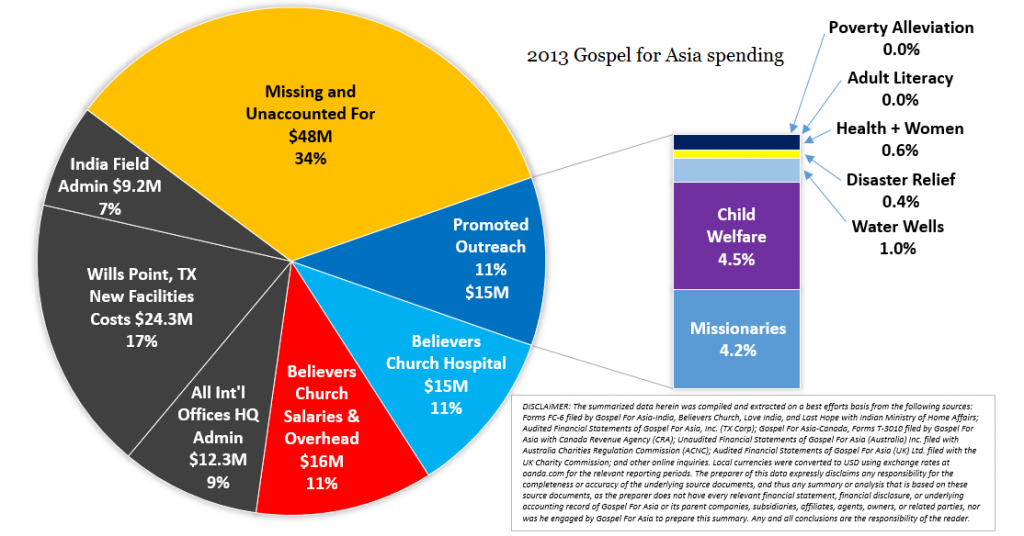

It is troubling that millions of dollars of donor money are unaccounted for in India. Recall that Canadian pastor Bruce Morrison received no answers when he asked GFA leaders why $43.5 million of American and Canadian donations was not reported in India. Morrison’s findings mirror mine and those of auditor Jason Watkins who examined public records of 2013 GFA spending:

Watkins found more funds missing ($48 v. Morrison’s $43.5 million) because he also examined records from the UK and Australia.

Since these funds are unaccounted for in India, then how can GFA-US make a case that it is exercising appropriate “discretion and control?” If GFA does have “discretion and control” over these tax-exempt funds, then why does GFA fail to answers questions from the public and donors about where the money goes?

Add these question to the growing list.