In a major departure from past practice, Gospel for Asia changed their ECFA page to include their U.S. financial information. Citing security concerns, GFA has declined to reveal this information on the web, but instead required interested parties to request it by mail. Up until now, the ECFA has allowed charter member GFA to be exempt from usual practice.

Now the page looks like this:

In a prior post, I noted that GFA sent $58 million to India but the FC-6 forms there show only a little over $6 million received from the U.S. Perhaps, GFA is moving toward more transparency. If so, the organization still has a long way to go to explain this discrepancy, as well as the money exporting to India, and discrepancies in the Bridge of Hope program reporting. Clearly, the organization is raising massive amounts of cash but has yet to explain why so much is sitting in Indian banks.

Given this change, perhaps the ECFA has been in talks with GFA and is privately working to bring GFA into compliance with ECFA guidelines. If this is true, don’t expect ECFA to alert the donating public. If the ECFA and GFA don’t see things the same way, my guess is that GFA will quietly give up their membership with no explanation.

Tag: Gospel for Asia

How Hard is it for Gospel for Asia to Get Money to the Field?

In a staff meeting on May 14, COO of Gospel for Asia David Carroll said it was getting hard to send money into India.

In a staff meeting on May 14, COO of Gospel for Asia David Carroll said it was getting hard to send money into India.

We’re always looking for ways to get money into India because the reality is that it’s getting more difficult to do that, and we are looking for other ways that we’re able to do that.

Given other information provided by GFA, this is a confusing statement.

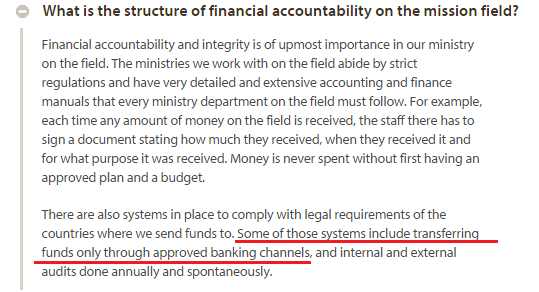

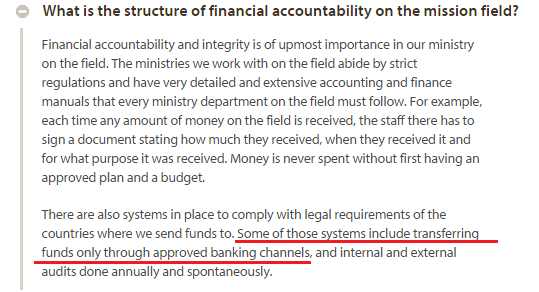

On GFA’s frequently asked questions page, GFA addresses financial integrity and tells donors that everything is ethical. On that page, GFA promises financial accountability:

The sentence underlined in red says: “Some of those systems include transferring funds only through approved banking channels.” Carrying cash in backpacks is not an approved banking channel. As I have reported, money smurfing is a violation of both federal law and this website promise to donors. So hard or easy, moving money is only supposed to be done through banks.

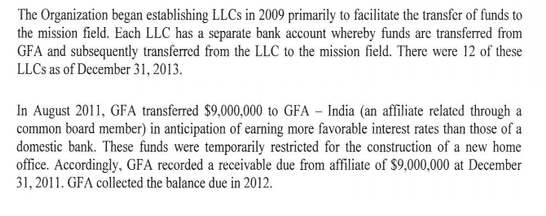

I have to also question if it is difficult to get money into India via legitimate means. According to the audited financial statement for 2012 and 2013, GFA started creating limited liability companies in 2009 to aid transfers of money to India. They now report 12 of them.

A quick review of the Indian FC-6 forms (e.g., GFA’s 2013-2014 FC-6) shows that GFA transfers money frequently. In fact, GFA decided to transfer $9 million to India just to get better interest rates. Apparently, any difficulty was worth it. See the relevant section of the financial statement in the image below:

GFA took $9 million which they needed for their new home office and transferred to that money to India for about a year to get better interest rates. Then they transferred it back. GFA was willing to place $9 million at risk; so how hard could it be to move money back and forth?

GFA has admitted money smurfing but to my knowledge, there has been no explanation to staff about why the students and money was put at risk. I am aware that staff are very concerned about it as they should be.

I encourage anyone who was asked by GFA to move cash on a trip to India (or elsewhere) to contact me at my email address (click the link). If you have questions about the matter, please feel free to contact me.

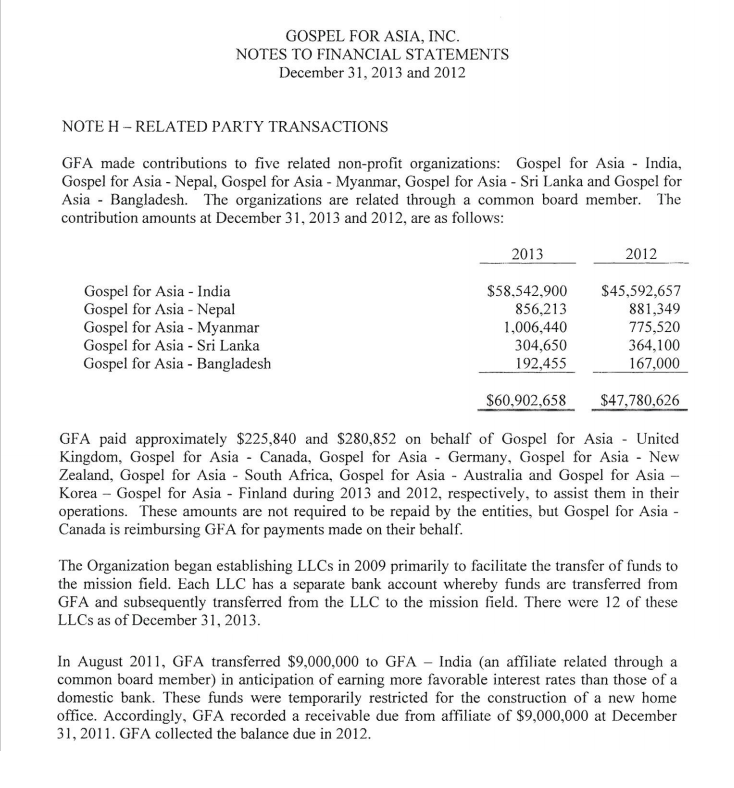

Gospel for Asia Reports One Thing in American Audit, Another in Indian Reports

In addition to the usual income and expenses data, Gospel for Asia’s audited financial statement discloses related party transactions. As you can see from the image below, the direction of the transaction is from the U.S. to GFA affiliates in Asian countries with 96% going to India. In addition to GFA India, GFA in the U.S. claims contributions to GFA affiliates in Myanmar, Sr Lanka, Bangladesh and Nepal. See below:

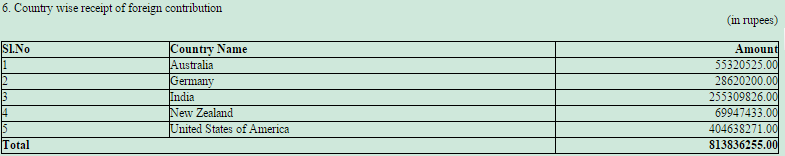

GFA reports contributions to five related non-profits. However, in the Indian FC-6 report, three other charities — Believers’ Church, Love India Ministries, and Last Hour Ministries — report receiving contributions from GFA in America. In the audited financial statement above, GFA reports to Americans that the organization gave $58,542,900 to GFA India in calendar year 2013. However, in the FC-6 form filed to the Indian government, GFA – India reported that much less than $58 million was received. Just from the U.S., GFA – India reported that they received INR 404,638,271 which converts to $9,170,270 million USD during the period between April 1, 2013 and March 31, 2014 (see line 5 below).*

GFA reports contributions to five related non-profits. However, in the Indian FC-6 report, three other charities — Believers’ Church, Love India Ministries, and Last Hour Ministries — report receiving contributions from GFA in America. In the audited financial statement above, GFA reports to Americans that the organization gave $58,542,900 to GFA India in calendar year 2013. However, in the FC-6 form filed to the Indian government, GFA – India reported that much less than $58 million was received. Just from the U.S., GFA – India reported that they received INR 404,638,271 which converts to $9,170,270 million USD during the period between April 1, 2013 and March 31, 2014 (see line 5 below).*

GFA said in the audited financial statement over $58 million was sent to GFA India, but GFA in India reported only a little over $9 million being received (actually more like $6 million, see the last note below).**** So where is the rest of the money?

As I reported in a prior post, GFA in America also sent money to at least three other charities in India: Believers’ Church (INR 909,041,794 = $20,601,500), Love India Ministries (INR 162173900 = $3,675,330) and Last Hour Ministries (INR 161084820 = $3,650,650) (click the links for their FC-6 forms). Looking at what came from the United States to all four of these entities, the total is $37,097,750 which still does not get us to the $58 million GFA claims came from the U.S.** It is possible that GFA – U.S. contributes to other ministries in India that have not been disclosed or discovered yet. However, just taking these reports at face value (what GFA says in the audited statement and what GFA tells the Indian government, there appears to be a significant discrepancy.

It is worth asking what Love India Ministries and Last Hour Ministries do. I can’t find a viable web presence for either entity and as far as I can determine, GFA does not mention them in their materials. They may be shell companies operating in name only, much like the 12 limited liability corporations in Texas mentioned in the audited financial statement which exist just to transfer money to the field.***

Thus, at least two problems emerge for GFA’s credibility. One, GFA claimed in the audited financial statement that it only contributed to “five related non-profit organizations.” However, GFA in the U.S. uses 12 LLCs to send money to at least three additional registered charities in India (Believers’ Church, Love India Ministries and Last Hour Ministries) which are not disclosed in the audited financial statement. Two, the amounts GFA says they send to GFA in India comes nowhere close to matching what GFA – India reports to the Indian government.

Thus far, GFA has remained silent in the face of questions regarding cash smurfing to India, video of Believers’ Church bishops bowing and kissing the ring of GFA president K.P. Yohannan in contradiction to Yohannan’s denials of the ritual, discrepancies in Bridge of Hope giving requests and spending, and cash hoarding in Indian bank accounts. These discrepancies being reported today now call into question the accuracy of the American audited financial statement. Silence may be a good PR strategy but it seems ill-suited for a Christian ministry.

*It seems very unlikely that the different reporting years explains the $ million difference. Both methods of accounting cover 12 month periods which report consistent monthly giving totals year over year.

**Contributions to GFA-India, Believers’ Church, Love India Ministries and Last Hour Ministries from all foreign sources (including interest on foreign contributions) totaled $54, 550,683 for fiscal year ending March 31, 2014, still less than the $58 million to India reported on the audited financial statement.

***As an aside, it is worth asking again why sending cash to India in student backpacks was ever done. GFA told students it is a way to get cash into India. As one can see from the financial statement, GFA set up 12 LLCs to transfer money, and even transferred $9 million at one point just to get better interest payments. There appears to be no problem getting money back and forth from India.

****I remembered after doing the post that India’s FC-6 forms require a charity to record when the contributions are received. Thus, I was able to discern the amount sent during the calendar year 2013 but looking at the reports for the fiscal years 2012-2013 and 2013-2014. The situation is actually worse than I first reported. GFA – India reported that they received only $6 million in calendar year 2013. The American audit says GFA U.S. sent $58 million to GFA India in the calendar year but GFA India only reported $6 million in the same time span.

Indian News Magazine Weighs In on Gospel for Asia and the Loss of Cheruvally Estate

Today, Tehelka, an award winning Indian investigative magazine, posted an article about the loss of the Cheruvally Rubber plantation to the government. Even though I posted on this topic recently, I thought this article added some facts and was interested in the tone of the report.

Today, Tehelka, an award winning Indian investigative magazine, posted an article about the loss of the Cheruvally Rubber plantation to the government. Even though I posted on this topic recently, I thought this article added some facts and was interested in the tone of the report.

Some snippets:

Kerala-based evangelist and self-consecrated archbishop Dr K P Yohannan has hit the headlines yet again, as the state government has recently issued orders to take over three estates his church body owns illegally. According to the government of India website, Gospel for Asia (GFA) – a Texas based charitable organisation – is funding ‘Believers Church’ for the purpose of charity to improve the condition of orphan children. Interestingly, both GFA and Believers Church are headed by Yohannan. The funds sent by GFA were used to purchase these estates instead of putting it to use for charity purposes.

I have been curious about perception in India regarding GFA’s purchase of land for commercial purposes. The writer of this article takes the position that the foreign contributions were used to buy commercial properties rather than for the intended purpose. This is a serious charge and one which GFA should address.

However, it has been learnt that Yohannan and his trust had spent Rs 300 crores on the plantation property. With the government now taking over the land, BC will in all probability face losses on their investments in these estates. Moreover, BC would possibly be ineligible for any compensation as Harrison Malayalam sold the property to BC when the former had no right to sell the property. After the purchase, however, the property was mutated in the name of the Believers’ Church and tax was being paid by the BC itself under the Plantation Tax Act.

Instead of $14.3 million, as I reported earlier, this article claims the price was much higher — $68.5 million. However, no source was given for the information which makes it impossible to verify.

An implication of this report is that a massive amount of donor funds may be lost due to the purchase of this property. Although GFA in India may have believed it had the better legal case, it is a legitimate question whether or not donor money should have been risked in this manner.

GFA has remained silent about a number of concerns recently raised by donors, former staff and students. Prominent among them is the report by former students that they were told to carry cash in backpacks and suitcases to India, seemingly at odds with American and possibly Indian law.

According to U.S. Customs and Border Protection, Smurfing – Dividing Cash Transfers Over $10k to Avoid Detection – Violates U.S. Law

On May 14, I wrote that several Gospel for Asia staff and students had reported to me that they were asked to carry envelopes of cash to India without declaring that cash to U.S. customs. I then reported audio of Gospel of Asia leaders telling staff and School of Discipleship students in a May 14 staff meeting that GFA leaders planned to discontinue the practice of having groups of students take large sums of cash to India in their pack backs or suitcases on group trips. In that staff meeting, a student raised the issue with a question about why GFA leaders required each student on a mission trip to carry an envelope of $4500 cash to India. Amounts ranging from $45,000 to $135,00o (possibly more, I have not interviewed individuals from groups larger than 30) have allegedly been taken to India in this manner. GFA gave no specific reason for asking students to do this, but said their Texas auditor Bland Garvey approved the plan.

On May 14, I wrote that several Gospel for Asia staff and students had reported to me that they were asked to carry envelopes of cash to India without declaring that cash to U.S. customs. I then reported audio of Gospel of Asia leaders telling staff and School of Discipleship students in a May 14 staff meeting that GFA leaders planned to discontinue the practice of having groups of students take large sums of cash to India in their pack backs or suitcases on group trips. In that staff meeting, a student raised the issue with a question about why GFA leaders required each student on a mission trip to carry an envelope of $4500 cash to India. Amounts ranging from $45,000 to $135,00o (possibly more, I have not interviewed individuals from groups larger than 30) have allegedly been taken to India in this manner. GFA gave no specific reason for asking students to do this, but said their Texas auditor Bland Garvey approved the plan.

However, any cash transfer over $10,000 must be declared via a customs form when leaving the U.S. None of my sources filed any forms on their trips. In addition, GFA on the organization website denies using such means to carry funds to the field, saying (see the underlined sentence):

Obviously and by their own admission, GFA leaders did not follow this guideline.

Wanting to understand more about the law relating to cash transfers out of the country, I contacted by phone and email the media relations department of the Customs and Border Protection agency within the Department of Homeland Security. To the CBP media office, I posed the exact scenario just as the GFA students explained it to me. In response, a CBP spokesperson wrote in an email to describe the relevant U.S. law:

If an individual transports, attempts to transport, or causes to be transported (including by mail or other means) currency or other monetary instruments in an aggregate amount exceeding $10,000 (or its foreign equivalent) at one time from the United States to any foreign place, or into the United States from any foreign place, they must file a report with U.S. Customs and Border Protection (CBP).

This requirement is cited in 31 USC 5316; 31 C.F.R. 103.23 and the Bank Secrecy Act (BSA) of 1970, which identifies the source, volume, and movement of currency and monetary instruments being transported into or out of the United States or being deposited in financial institutions. The BSA aids law enforcement officials in the detection and investigation of criminal, tax, and regulatory violations.

CBP widely publicizes the currency reporting requirements on its website and through other means in order for travelers to be aware of the requirement to file a FinCen Form 105, Report of International Transportation of Currency or Monetary Instruments (CMIR). If unreported currency or monetary instruments are discovered on a person or in his carry-on luggage while boarding a departing aircraft this would constitute a CMIR violation.

Dividing currency amongst travelers requires the filing of a CMIR for the entire amount as intentionally aggregating currency exceeding $10,000 to evade reporting is against the law.

As a result of international drug trafficking, the United States and much of the world strengthened currency reporting requirements by enacting laws to counter money laundering schemes such as “Smurfing”. Smurfing is a form of structuring, or dividing large amounts of currency or monetary instruments between individuals within an organization, with each person or package carrying an amount under $10,000 to circumvent reporting requirements. Structuring, including “smurfing”, is a violation of 31 USC 5324. (emphasis added)

I then asked the public affairs office at Immigration and Customs Enforcement how their office handles such crimes. A spokesperson told me that no information could be given about current investigations, but persons who wish to pass along information can use the ICE tip line: http://www.ice.gov/tipline.

I also request that former/current staff, students or others who carried cash for GFA contact me via email (click the link).