I didn’t watch the first debate but so far the consensus is that Carly Fiorina won it.

On the second debate, I liked John Kasich the best but felt several of the candidates did well. Trump was the loser in my view. His message is everybody is stupid except me which is why all you stupid people should vote for me.

Rand Paul didn’t have a good night either. I thought Christie debated well.

Open forum on the debates.

Month: August 2015

Gospel for Asia and ECFA: Is Reporting Information About An Organization Harassment?

Gospel for Asia has not answered any requests for information from me since May 7. GFA’s COO David Carroll told me my questions had become too frequent and numerous for them. Former donors have also asked many of the same questions I have asked. Many former donors have written to tell me that GFA representatives said the Evangelical Council for Financial Accountability advised GFA not to talk to me. I have seen evidence that GFA is internally telling staff that they refuse to answer questions from me at the advice of ECFA. That would not be surprising since ECFA has not responded to my questions for months.

If indeed ECFA is advising a member organization not to answer questions from me, what could be the reason? I will address a possible rationale in a moment. However, before I do, it is worth asking GFA publicly: why won’t you answer questions from donors? Former donor and Canadian pastor Bruce Morrison asked you many questions about discrepancies between U.S. records and Indian reports. You didn’t answer them. He and his church supported GFA for 20 years. Former donor and blogger Jimmy Humphrey supported GFA for years until recently. However, he told me you didn’t have any answers when he wanted to know why discrepancies exist between U.S. and Indian records. GFA sent him a form letter but no specific answers. I have heard similar stories from over a dozen former donors; some of them are posting at the Phoenix Preacher blog (see the comments section of this post).

Now about GFA’s silence in response to my questions:

The ECFA has a guideline called Transparency. Generally, it encourages organizations to be open about their dealings and specifies that ECFA member organizations must provide an audited financial statement upon request. GFA provided me with a copy of that statement when I asked back in April. This is the one area where compliance with ECFA guidelines has been advantageous. If the ECFA sticks by its own rules, the 2014 audited statement should be available soon because it was due to be filed with ECFA by July 31.

An aspect of the Transparency guideline gives a member organization a loophole for disclosure of the audited statement. If the organization deems that the request is part of a harassment campaign, then the group is exempt.

Harassment campaign. An organization may be exempted from the requirement to provide a copy of its financial statement if ECFA determines that the organization is the subject of a harassment campaign, the requester is part of that campaign, and compliance with requests that are part of that campaign are not in the public interest.

What constitutes harassment? A group of requests for an organization’s documents is indicative of a harassment campaign if the requests are part of a single, coordinated effort meant to disrupt the operations of the organization rather than to collect information about the organization.

In ECFA speak, this exemption applies to requests for audited financial statements and is based on IRS guidance about disclosure of a tax exempt organization’s 990 form. Since tax exempt groups are supposed to operate for the public benefit, public accountability is served by the government requiring non-profits to file a disclosure of income and expenses via the 990 form. However, GFA doesn’t file a 990 since the organization is considered a religious order by the IRS.

The ECFA spells this out to members in a document on their website which provides the relevant IRS guidance. Reviewing the IRS guidance, it becomes clear that ECFA has adapted IRS language to their guideline for disclosure of financial statements. Organizations are not required to provide 990 forms under the following circumstances:

§ 301.6104(d)–3 Tax-exempt organization subject to harassment campaign. (a) In general. If the district director for the key district in which the [26 CFR Ch. I (4–1–06 Edition)] organization’s principal office is located (or such other person as the Commissioner may designate) determines that the organization is the subject of a harassment campaign and compliance with the requests that are part of the harassment campaign would not be in the public interest, a tax-exempt organization is not required to fulfill a request for a copy (as otherwise required by § 301.6104(d)–1(a)) that it reasonably believes is part of the campaign.

What defines harassment?

(b) Harassment. A group of requests for an organization’s application for tax exemption or annual information returns is indicative of a harassment campaign if the requests are part of a single coordinated effort to disrupt the operations of a tax-exempt organization, rather than to collect information about the organization. Whether a group of requests constitutes such a harassment campaign depends on the relevant facts and circumstances. Facts and circumstances that indicate the organization is the subject of a harassment campaign include: a sudden increase in the number of requests; an extraordinary number of requests made through form letters or similarly worded correspondence; evidence of a purpose to deter significantly the organization’s employees or volunteers from pursuing the organization’s exempt purpose; requests that contain language hostile to the organization; direct evidence of bad faith by organizers of the purported harassment campaign; evidence that the organization has already provided the requested documents to a member of the purported harassing group; and a demonstration by the tax-exempt organization that it routinely provides copies of its documents upon request.

The IRS does not require non-profits to answer endless requests for the same form from coordinated sources. Doing so would take up too much time and resources and might be designed to disrupt the organization’s functioning. Even so, an organization cannot simply declare itself the subject of a harassment campaign and be free from the disclosure requirement. The organization has to request a determination by the IRS within 10 days of the organization’s leaders believing the organization to be the subject of a harassment campaign. According to the guidelines:

(d) Harassment determination procedure. A tax-exempt organization may apply for a determination that it is the subject of a harassment campaign and that compliance with requests that are part of the campaign would not be in the public interest by submitting a signed application to the district director for the key district where the organization’s principal office is located (or such other person as the Commissioner may designate).

To my knowledge, Gospel for Asia has not requested any such determination. You can read the rest of the procedure at this link (page 91).

Clearly, none of this applies to media, public, or donor requests for information about financial dealings. Neither the IRS nor the ECFA guidelines advise or allow a public charity to ignore questions about public documents (audited statements, reports filed with the Canadian and Indian governments) already filed by the organization. If indeed the ECFA advised a Christian ministry to refuse to answer questions about finances from other Christians, then we have a whole new way of defining “evangelical financial accountability.”

Clearly, none of this applies to media, public, or donor requests for information about financial dealings. Neither the IRS nor the ECFA guidelines advise or allow a public charity to ignore questions about public documents (audited statements, reports filed with the Canadian and Indian governments) already filed by the organization. If indeed the ECFA advised a Christian ministry to refuse to answer questions about finances from other Christians, then we have a whole new way of defining “evangelical financial accountability.”

In the Public Interest

Let’s make this very clear. There is no harassment campaign. GFA did not try to work with me as one GFA representative said according to former donor Jimmy Humphrey. There is no reason in the public interest either here or in India for GFA to hide information or fail to answer questions about discrepancies in financial reports available freely to the public. There is no reason in the public interest for the ECFA to advise their member organizations not to talk to me or any other writer.

If anything is true, it is that GFA has operated in such a way as to thwart the public’s interest in knowing how tax exempt donations are spent. For instance, without brave former staffers disclosing the money smuggling to India, the public wouldn’t know that, GFA, a tax exempt religious order, conducted business in violation of its own standards and possibly U.S. Customs law. GFA began by telling staff that the procedure was legal and they cleared it with their auditors. Later, ECFA told Christian Today that GFA was seeking “legal counsel” to determine “remedial measures”:

It confirmed that GFA had sent cash with individuals travelling to India, but said that it had “stopped this practice entirely, and is working with legal counsel to determine appropriate remedial measures, if any”.

If the practice is legal and cleared with auditors Bland Garvey, why check with lawyers?

Maybe there are good answers for every question. If so, the public interest demands that GFA answer them. If not, then whose interest is served by silence?

Gospel for Asia Suspends All Travel to India Until the End of the Year

This news is coming out of Gospel for Asia in the U.S. Gospel for Asia India has requested that their foreign offices suspend all vision tours and travel to their office, stating “the increased persecution on the field makes it too dangerous for anyone to travel to India until the end of the year.”

All trips and travel plans have been “immediately suspended” including the School of Discipleship January class’ trip that was scheduled for late September.

Persecution in India has increased some under the government of Prime Minister Narendra Modi according to an April report by the U.S. State department. However, GFA sent a group of students to India in April, each carrying $4500 in U.S. currency without declaring it in the U.S. or India. It was not disclosed what, if anything, has changed since April to spark this move.

No travel warnings to India have been issued by the U.S. State Dept. during 2015. Some concerns have been expressed by the Canadian government about areas bordering Pakistan and Burma but nothing general and no advisories have been issued for Kerala where the Gospel for Asia and Believers’ Church headquarters are located.

Gospel for Asia and Evangelical Council for Financial Accountability's Standard 4

Yesterday, I wrote that Gospel for Asia may be in conflict with IRS guidelines regarding granting U.S. tax exempt donations to foreign entities. Today, I want to compare publicly available information about GFA to the Evangelical Council for Financial Accountability’s Guideline Four. In this post, I am specifically interested in the ECFA requirements for members who send money to foreign organizations and affiliates.

Yesterday, I wrote that Gospel for Asia may be in conflict with IRS guidelines regarding granting U.S. tax exempt donations to foreign entities. Today, I want to compare publicly available information about GFA to the Evangelical Council for Financial Accountability’s Guideline Four. In this post, I am specifically interested in the ECFA requirements for members who send money to foreign organizations and affiliates.

ECFA members are required to adhere to the following guidelines:

International grant-making. U.S. tax law does not prohibit the making of grants by a U.S. tax-exempt organization to recipients in other countries if they further the U.S. organization’s tax-exempt purposes. However, the IRS has articulated some parameters as to when contributions may or may not be deductible for tax purposes, if they are made to a U.S. charity and subsequently distributed in the form of a grant to a foreign recipient.

The reason for IRS scrutiny of such grants is because only donations to a U.S. tax-exempt organization are deductible as charitable contributions. Contributions by a U.S. taxpayer to a foreign organization are not tax-deductible.

A U.S. charity may not act merely as a conduit of funds for a foreign recipient. This would result in treating these indirect contributions to a foreign organization as tax-deductible contributions, something that would not be allowed if the funds were made directly to the foreign entity.

However, if a grant is made by a U.S. charity to further its exempt purposes, and if the grant funds are clearly under the control and discretion of the U.S. charity rather than the donor, it is unlikely that the IRS will challenge the deductibility of the gift.

The issue of “discretion and control” is what I raised yesterday. GFA-US did not disclose millions of dollars of U.S. donor money given to Believers’ Church, Love India Ministry and Last Hour Ministry in the 2013 annual audit. Instead, GFA-US claimed that $58.5 million went to GFA-India. However, GFA-India only disclosed $6.5 million in donations from the United States. Even if donations from GFA-US to the other three NGOs were listed in the 2013 audit, $30.5 million dollars still went unreported in India in 2013 (see this article for the breakdown).

The real donees for about $28 million dollars from U.S. donors are Believers’ Church, Love India Ministry and Last Hour Ministry. According to GFA-US, Believers’ Church is a separate organization legally. Recently, David Carroll told Christian Today:

GFA’s Chief Operating Officer David Carroll told Christian Today that it was important to understand that GFA India and Believers Church were separate entities from Gospel for Asia USA.

Carroll said that the Indian GFA and Believers’ Church are responsible for dispersing the funds:

“Though Gospel for Asia India and Believers Church is responsible for dispersing the funds, they know the requests of the donors for the specific designations the money was given for and they are fastidious about documenting the disbursement of donor funds. The donations go where they have been designated.”

It may be true that the donations go where the donors want, but then again they may not. GFA has given the public reasons to question. David Carroll wants us to take his word that GFA-India and Believers’ Church spend the money in keeping with donor intent. However, when auditor Jason Watkins, pastor and former donor Bruce Morrison, and I analysed the public reports of GFA-India’s and Believers’ Church’s spending in India, we couldn’t find millions of dollars GFA-US said was sent to India. The reports of what was received in India don’t match the claims of giving in the U.S. In response to questions about the discrepancy, GFA has been silent. Furthermore, an Indian tax court recently wrote that GFA used funds for reasons not in keeping with the intended purpose. Without a plausible accounting of millions of donor dollars, why should the donor public believe that GFA-India and BC are spending the funds they do report in keeping with donor intent?

The guidelines continue:

Organizations may seek professional counsel concerning operations that result in grants to foreign recipients. Various rulings and tax cases stipulate certain characteristics in evaluating whether grants to foreign recipients are proper, exempt-purpose expenditures of the U.S. charity and, therefore, if any supporting gifts actually are deductible by donors of those funds.

Impact of international operations on the financial statements. It is important for organizations to properly control, adequately account for, responsibly audit, and fully disclose in their financial statements the nature and scope of their operations, both within the U.S. and internationally. Organizations and their auditors should consider the impact of worldwide operations on the scope of the audit, and the financial statements should report on all organizational assets, liabilities, revenue, and expenses.

This guideline is not being met. The 2012 and 2013 audits do not disclose funds given to Believers’ Church, Love India Ministry and Last Hour Ministry. The amount claimed to be given to GFA-India by GFA-US comes nowhere close to matching up with what is reported in India. Furthermore, GFA’s audit doesn’t include $14 million USD given by Canadians, supposedly to India, but not reported in India. According to GFA’s COO David Carroll, Canadian funds are lumped in with the U.S. funds and reported together. However, that makes the discrepancy $14 million greater since GFA-India does not report a penny coming from Canada.

The publicly available audit provided by GFA does not fully disclose their operations within the U.S. and internationally. This has been true for years and yet GFA has used the ECFA seal of approval to claim financial health and integrity. As recently as June 10, the ECFA told Christian Today:

Regarding apparent financial discrepancies, it said: “There are certain foreign NGOs that include ‘Gospel for Asia’ in their name. The data of those NGOs is not consolidated with that of Gospel for Asia (US) for financial statements purposes.”

Why not? ECFA’s guideline four certainly appears to require consolidated reports.

It [ECFA] concluded: “Gospel for Asia is in full compliance with ECFA in requiring our members to provide a copy of its current financial statements upon written request and other disclosures as the law may require. The organisation has gone beyond what the law requires by submitting to ECFA’s accreditation process.”

Is GFA-US (and ECFA) really going to claim that these GFA NGOs are not part of their international operations? If so, then how can GFA-US claim that they exercise “discretion and control” over the donations given by U.S. tax payers? If GFA-India and Believers’ Church are so autonomous that they are not part of ECFA-required financial reporting, then how can U.S. donors be confident that GFA-US has sufficient “discretion and control” to make sure those dollars are going where donors specify? This question is especially relevant since the reports filed by the Indian recipients of U.S. donations to GFA don’t match what GFA claims they send to India.

Back to the guidelines:

To be “unqualified” or “clean,” an independent auditor’s report must reflect no restriction on the scope of the audit.

The reach of an organization extends to activities conducted under its control (internationally) when expenditures are made to further its exempt purposes to compensate workers, pay business expenses, provide benevolence to the poor and needy, or to make exempt-purpose grants.

These “exempt purposes” are among the purposes reported in India for funds sent by GFA in Texas.

The guidelines continue:

In order for financial statements to be in conformity with generally accepted accounting principles (GAAP), they must accurately portray the full range of the organization’s operations internationally.

A review of GFA’s 2012 and 2013 audits makes it clear that GFA is in violation of this statement. The financial status of the Indian affiliate (what GFA-India is called in the 2013 financial statement) is not reported, nor are donations to Believers’ Church, Love India Ministry and Last Hour Ministry reported in the audit. I should add that the funds smurfed to India via student groups illegally carrying money to India without being declared in the United States is not referred to in the 2012 and 2013 audits.

Guideline 4 continues:

The FASB Accounting Standards Codification 958-205 (Topic 205, “Presentation of Financial Statements”) sets forth that such statements must focus on the organization as a whole, including its total assets, liabilities, net assets, revenue, expenses, and changes in net assets. In addition, ASC-810 (Topic 810, “Consolidation”) helps guide a reporting organization as to when it must consolidate another not-for-profit organization in which it has a controlling financial interest.

Significant granting activities should be properly disclosed in an organization’s financial statements, including a description of the nature and purpose of the grants and the grant administration policies.

I think $20.6 million to Believers’ Church, $3.6 million to Last Hour Ministry and $3.6 million to Love India Ministry would have to be considered “significant granting activity.” These are not disclosed in the financial audit done by Bland Garvey; and yet ECFA declares GFA to be in compliance.

Guideline 4 continues:

Grant administration policies should be well-developed and approved by the governing board, while adaptable to a wide range of circumstances. The following are possible controls and accountability measures:

- Written progress reports

- Required accounting or financial statements

- Required internal or independent audits and inspections

- On-site program inspections by grantor personnel

- Retaining discretion as to when funds will be remitted based on administration policies and grant agreements, including the policy and practice of refusing conditional or earmarked gifts that create an obligation to remit the funds immediately

- Adequate oversight (supervision) and review (program evaluation) or compliance with administration policies by the governing board and/or the organization’s independent auditors

Conformity with applicable laws and regulations. Standard 4 establishes the guideline that ECFA accredited organizations shall use resources in conformity with applicable laws and regulations. The standard provides a caveat that biblical mandates may be taken into account when considering conformity with laws and regulations. In select situations, an accredited organization may feel compelled to take actions that are in conflict with certain laws, i.e., with respect to religious freedoms and carrying out the Great Commission.

The ECFA requires the board and auditors to maintain oversight sufficient to insure that the organizations policies are being carried out. The public doesn’t know why millions of dollars don’t show up in Indian reports. However, it is known and now admitted that GFA violated its own policies regarding cash transfers to India via smuggling cash via students. GFA claims to only send money to foreign destinations via bank wire. For some undisclosed period of time an undisclosed sum of cash was sent to India without declaring the cash to U.S. or India customs. ECFA and GFA want all of that to go away by saying they won’t do it again.

What donors should understand is that GFA was a member in good standing the entire time they violated their own and ECFA’s standards. They remain a member in good standing with no consequences at all to that standing.

For ECFA purposes only, the last section may give GFA some wiggle room to keep secrets about reporting funds received in India. If GFA-India isn’t reporting all of the income that GFA-US claims is going there (we already know an Indian court has asserted that all the funds are not being used for the intended purposes), this would be a violation of Indian law. The lack of reporting of Canada as a source of $14 million USD appears to be a violation of Indian law. GFA might claim that the lack of reporting was due to protecting missionaries in some way. This seems to be the GFA response line but I have heard no plausible explanation about how non-disclosure of some funds but not others protects anyone’s safety.

How Does Gospel for Asia Exercise Discretion and Control of U.S. Tax-Exempt Contributions Given to Asia?

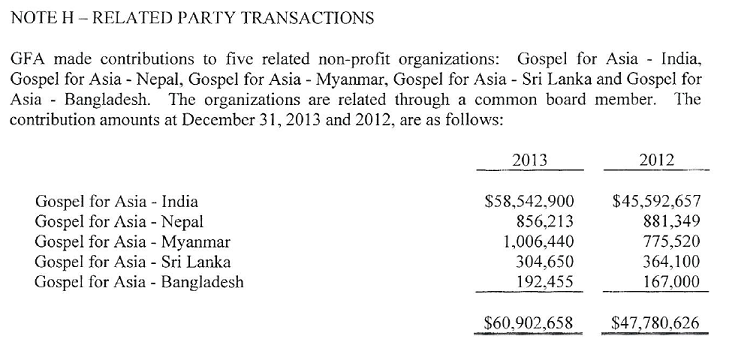

Other than to operate the School of Discipleship, Gospel for Asia in Texas appears to exist to collect donations and send them to various countries in Asia where locals carry out various charitable and religious activities. The foreign donations are wired (or smuggled) to NGOs in India and other nations in Asia. According to GFA’s 2013 audit financial statement nearly $60.1 million dollars were wired to five GFA related parties in India, Myanmar, Nepal, Sri Lanka, and Bangladesh. See below:

In addition, we know that GFA also sent money to Believers’ Church, Last Hour Ministry, and Love India Ministry, three NGOs registered with the Indian government. For some reason, these transactions were not disclosed in the 2013 audit as related party transactions, even though K.P. Yohannan is involved with those organizations. These contributions claimed by GFA to the related parties is a substantial part of what GFA takes in from American donors. As I have pointed out before, a substantial amount of this money does not show up on reports of foreign contributions which are required to be filed with the Indian government (see below).

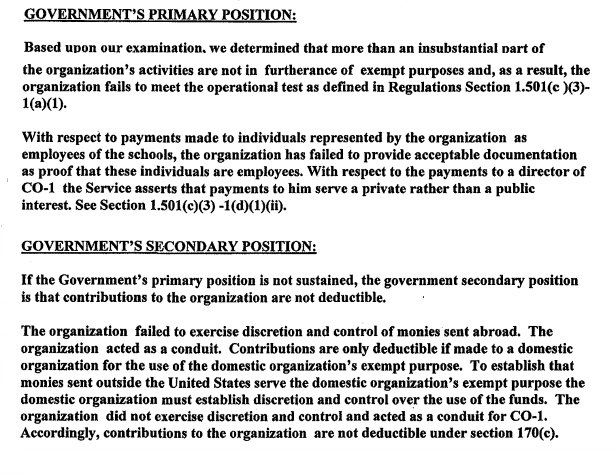

These facts might be of some consequence if the IRS decides to look into GFA’s operations. In June of this year, the Evangelical Council for Financial Accountability posted the following advice for member organizations. As I read it, this advice and the IRS decision has relevance to GFA.

Earlier this year the IRS stripped the tax-exempt status of an unnamed “American Friends of” organization because more than a substantial part of the organization’s activities did not further its exempt purpose. However, the IRS stated that even if its ruling would be overturned on appeal, contributions to the organization would nonetheless not be deductible because the organization failed to exercise sufficient control and discretion over its funds.

“American Friends of” organizations support the exempt purposes of foreign organizations by raising financial support for them in the United States. Donations to an “American Friends of” organization are generally deductible, but only if the organization can prove it exercises sufficient control and discretion over the donated funds to ensure that the funds are being used to further the exempt purposes of the organization. In other words, to maintain deductibility of donations, an “American Friends of” organization must be more than a conduit; rather, it must exercise full control and discretion over where its funds are distributed and how they are used.

In the recent ruling, there were two key factors identified by the IRS in determining that the organization was acting as a conduit between donors in the United States and the foreign organization. First, the organization did not maintain contemporaneous substantiation that it exercised control and discretion of its funds as outlined in Revenue Rulings 63-252 and 66-79. Second, the organization could not prove that it funded specific projects which it reviewed in advance; rather, the evidence showed that disbursements were made for the general operating expenses of the foreign organization.

This ruling is a reminder of the importance of keeping detailed, contemporaneous records to substantiate how an organization exercises control and discretion over its funds, particularly when disbursements are made to organizations to which deductible contributions cannot be made directly (which includes many foreign exempt organizations). For additional details, the IRS ruling can be accessed via this link.

The link leads to a redacted IRS determination regarding tax exempt status of an unnamed organization with most operation in a foreign country. The conclusion was Is GFA-India (and the other countries) a related party or is GFA-United States doing business in India as GFA-India? I may not be asking this precisely but the point of the question is to wonder out loud if GFA leaders in America are in charge of how American contributions are spent in India. The FC-6 reports filed by GFA-India, Believers’ Church, Last Hour Ministry and Love India Ministry indicate that funds are spent for salaries and other operating costs, as was the case with the unnamed charity which was investigated by the IRS. A fair question for GFA is: Who is exercising “discretion and control” of the funds sent to GFA-India, Believers’ Church, Love India Ministry and Last Hour Ministry?

Is GFA-India (and the other countries) a related party or is GFA-United States doing business in India as GFA-India? I may not be asking this precisely but the point of the question is to wonder out loud if GFA leaders in America are in charge of how American contributions are spent in India. The FC-6 reports filed by GFA-India, Believers’ Church, Last Hour Ministry and Love India Ministry indicate that funds are spent for salaries and other operating costs, as was the case with the unnamed charity which was investigated by the IRS. A fair question for GFA is: Who is exercising “discretion and control” of the funds sent to GFA-India, Believers’ Church, Love India Ministry and Last Hour Ministry?

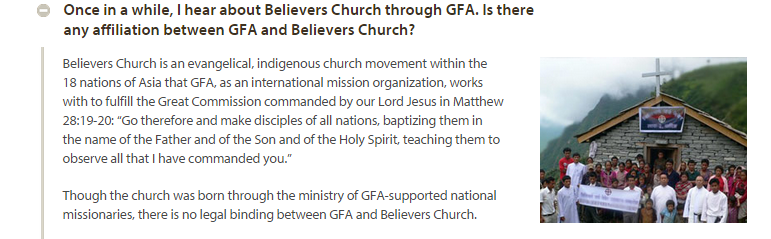

In this context, it is concerning that Believers’ Church, Love India Ministry and Last Hour Ministry are not mentioned in the audit, nor is it clear that GFA-US even claims “discretion and control” of funds sent to these groups. For instance, according to GFA’s website, Believers’ Church and GFA have no “legal binding” relationship:

How then can GFA-US have “discretion and control” of the funds donated to GFA but given by GFA to Believers’ Church? Perhaps that is why BC builds hospitals and schools and runs a micro-finance lending organization and in Myanmar even sponsors a soccer team.

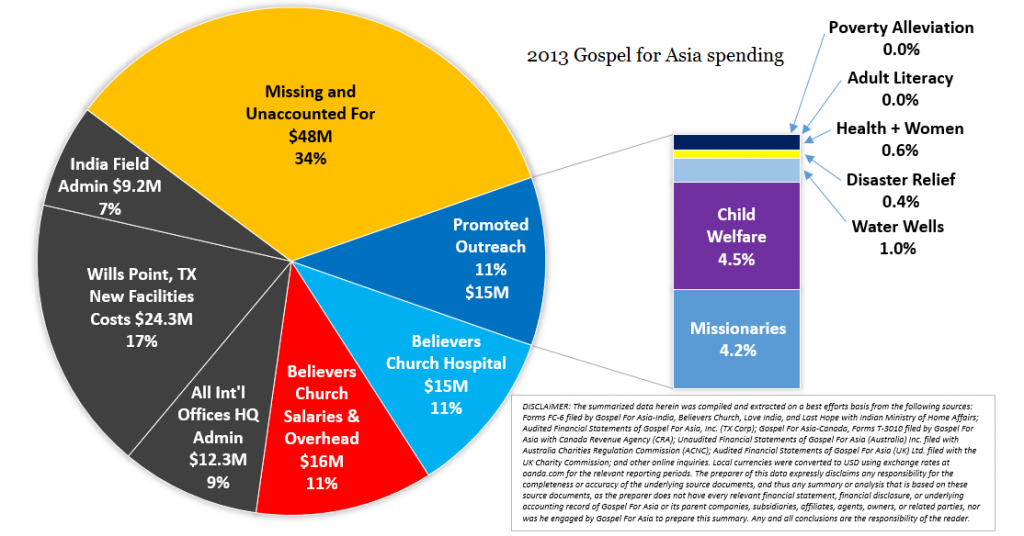

It is troubling that millions of dollars of donor money are unaccounted for in India. Recall that Canadian pastor Bruce Morrison received no answers when he asked GFA leaders why $43.5 million of American and Canadian donations was not reported in India. Morrison’s findings mirror mine and those of auditor Jason Watkins who examined public records of 2013 GFA spending:

Watkins found more funds missing ($48 v. Morrison’s $43.5 million) because he also examined records from the UK and Australia.

Since these funds are unaccounted for in India, then how can GFA-US make a case that it is exercising appropriate “discretion and control?” If GFA does have “discretion and control” over these tax-exempt funds, then why does GFA fail to answers questions from the public and donors about where the money goes?

Add these question to the growing list.