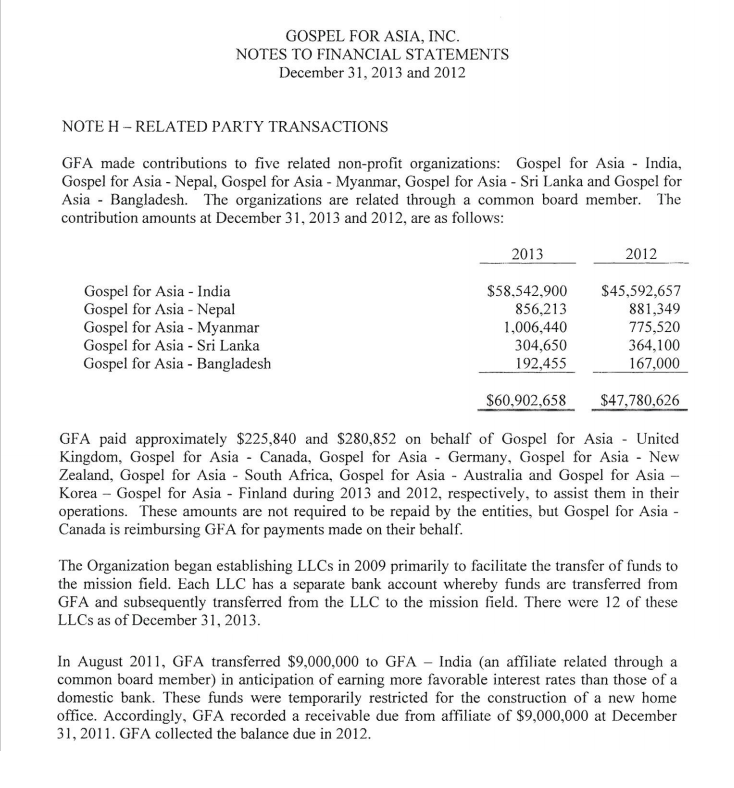

In a Christian Today article from yesterday, Mark Woods was able to secure some answers to questions I have been posing on this blog. In response to massive cash reserves being held in Indian banks, COO David Carroll said bank balances change as money is spent and deposited.

GFA’s Chief Operating Officer David Carroll told Christian Today that it was important to understand that GFA India and Believers Church were separate entities from Gospel for Asia USA. While he did not provide detailed figures, when asked about the cash reserves apparently held in Indian accounts, he said: “Like any nonprofit organisation or ministry, money in these bank accounts ebbs and flows throughout the year. It does not just sit there. The account balance will swell and then decline as the money is spent according to donor designations.”

In other news, water is wet.

In other news, water is wet.

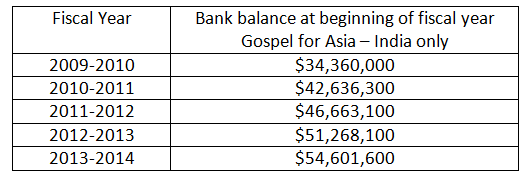

Of course, the balances change but GFA’s surplus has been swelling for years. One nice feature of the Indian FC-6 forms is that balances at the beginning and end of the fiscal years are reported. Looking at just GFA’s balances (remember, GFA in the U.S. sends donor money to at least four Indian NGOs – GFA-India, Believers’ Church, Love India Ministries, and Last Hour Ministries), the balances have been doing more flowing than ebbing.

The above figures do not include money sent from GFA in the U.S. to the other three Indian NGOs. However, the rate of increase is about the same to the point where now all four organizations have more than $150 million just sitting in bank accounts.

Looking the growth of the balances, GFA in the U.S. continues to tell donors that so much could be done if only there was enough money. GFA has money stored away and that has been growing steadily.

I will end this post by previewing a future one. As I have done these calculations, I have noticed that the value of the rupee has declined over this period. By sending so much American money to India and letting it sit in banks, millions have been lost to currency devaluation. In my conversations with those knowledgeable currency exchange rates, they tell me it is better to keep money in the U.S. until it is actually needed on the field. It is easy to see why this is true. The minute you send money to India, you lose some of it. And the longer it sits there, the less it is worth. This method of management of the funds has lost millions of dollars over the years.