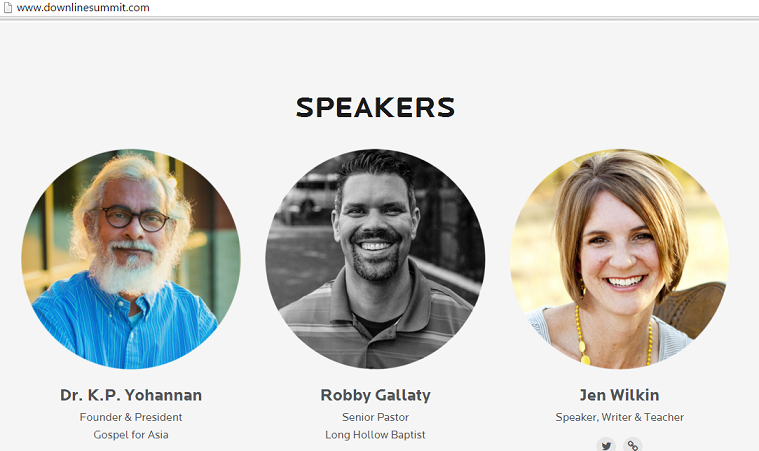

Yesterday, I posted a link to a Memphis missions conference which featured Gospel for Asia’s K.P. Yohannan as a speaker. Today, I have learned that the Downline Summit conference director is now telling people who ask that Yohannan and the organizers have agreed Yohannan will not appear. A trip to the conference website fails to find Yohannan’s picture or any references to GFA.

Yesterday, I posted a link to a Memphis missions conference which featured Gospel for Asia’s K.P. Yohannan as a speaker. Today, I have learned that the Downline Summit conference director is now telling people who ask that Yohannan and the organizers have agreed Yohannan will not appear. A trip to the conference website fails to find Yohannan’s picture or any references to GFA.

Still on GMMA 2016 Schedule

Another organization which has not decided what to do with K.P. Yohannan is the Global Medical Missions Alliance. Yohannan is slated to speak at their 2016 conference. Recently, Joy Kim, representing GMMA, told me that the GMMA board has been deliberating about Yohannan’s role at the Irvine conference in late June.

Category: Gospel for Asia

Indian Government Reverses Course, Says Gospel for Asia's Land Use Was Illegal

In November 2015, I wrote about a special deal Gospel for Asia got from the Indian government. GFA essentially violated wetlands regulations by re-routing a stream and filling in wetlands as a part of the construction of the Believers’ Church Medical College. However, in November of last year, the Times of India reported that the government planned to let the violations slide.

In November 2015, I wrote about a special deal Gospel for Asia got from the Indian government. GFA essentially violated wetlands regulations by re-routing a stream and filling in wetlands as a part of the construction of the Believers’ Church Medical College. However, in November of last year, the Times of India reported that the government planned to let the violations slide.

But then, on January 22, the Times of India reported that the federal government reversed the decision:

An order issued by principal secretary (revenue) Viswas Mehta on January 14, accessed by TOI, says the earlier order issued on March 17, 2015 on the basis of a cabinet decision – ratifying the land filling and diversion of a natural stream in the area -has been cancelled after the high court intervened in the matter.

The cabinet note of March 11, 2015, also accessed by TOI, said the illegal filling, though violating the Kerala Land Use Act, could be regularized by considering it as a special case.

The allegation is that GFA willfully violated the law by reclaiming land that was protected by Indian law.

Gospel for Asia's CEO K.P. Yohannan to Headline Memphis Missions Conference

Apparently, the Metropolitan will return to the United States for a missions conference in February. K.P. Yohannan is scheduled to speak at the Downline Summit which takes place at Hope Church in Memphis, Feb. 5-6.

Apparently, the Metropolitan will return to the United States for a missions conference in February. K.P. Yohannan is scheduled to speak at the Downline Summit which takes place at Hope Church in Memphis, Feb. 5-6.

Yohannan’s organization hasn’t had the best year since April 2015. Gospel for Asia lost their membership with the Evangelical Council for Financial Accountability, was denied membership in the Independent Charities of America, was sanctioned to greatest extent possible by the U.S. Office of Personnel Management for violations of federal guidelines, was reported to the Canadian authorities for violation of GFA’s Canadian by-laws, and may be investigated by the U.K. Charity Commission, among other problems.

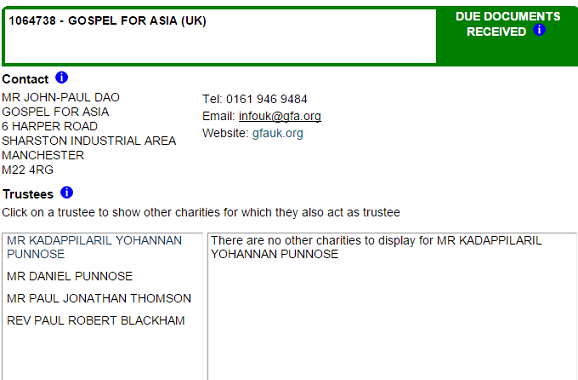

U.K. Charity Commission Considering Probe of Gospel for Asia

The Gospel for Asia rumbles have reached across the pond.

Earlier today, the Civil Society News reported that a Charity Commission spokesperson told them that “The Charity Commission is assessing the information provided to see what role there is for the Commission.”

The article referred to reports from this blog and Christianity Today as playing a role in the assessment.

The UK board is much like other boards. K.P. Yohannan and his son sit on the board with two others. The independent members could easily be stalled by K.P. and his son’s contrary votes.

Canadian Church Pulls Support for Gospel for Asia

Faith Mennonite Church yesterday alerted the congregation that Gospel for Asia will be removed from their offering schedule for at least two years.

As a leadership team, we have been watching the situation with GFA (Gospel for Asia) as significant concerns unfold about their financial management over the past number of months. Given the most recent updates that we have seen, along with a lack of response to our query to GFA Canada for clarity on the situation, we have decided that it is appropriate to remove GFA from our offering schedule for the two years remaining in this offering cycle. While this situation is unfortunate, we feel that this is the path of most diligence at this time, given the information that we have been provided.

For an outline of the situation, please read this article from Christianity Today :http://www.christianitytoday.com/ct/2015/december-web-only/report-details-why-gospel-for-asia-lost-ecfa-membership.html

For some background reading, please review:

For GFA USA’s initial response, please read here:

For a response from a Canadian pastor, please read here:

/wp-content/uploads/2015/07/A-Pastors-Appeals-to-Gospel-For-Asia-final-draft.pdf

On Tuesday, I disclosed that K.P. Yohannan fired two board members without due process and possibly in violation of Canadian law. Last year, I reported that Canadian contributions to GFA India were not reported in India.